Part I

Board Blind Spots: 12 Cognitive Biases that can Hamper Corporate Performance

The other day, a friend asked me why the world seems to be heading back into another COVID spiral. He believed that we would have everything under control by now.

His question reminded me of how easily we can fool ourselves because of cognitive biases that shape our perception of reality.

For example, after nine months of social distancing, working from home, and wearing masks, most people are sick of guarding against infection. During the summer and early fall, as infection rates went down, people assumed we had COVID under control and that this winter would be better than last. While logical on several levels, this assumption involved a great deal of projection and hopeful thinking. We seized on optimism and took a trend and extended that into the future.

Businesses make decisions based on assumptive fallacies all the time. In the whirl of everyday events, we may not know how much and how many cognitive biases play a role. As the ultimate over-seer and provider of wise counsel, one thing a Board can do is to test assumptions for faulty thinking. In this series, I wanted to lay out some potential areas where such risk can come into play.

1. Gambler’s Fallacy

This is the assumption that the odds of something happening accumulate because of past trends. So, if we flip a coin five times and come up with “tails” each time, it’s easy to believe the odds are better for the next flip to be “heads.” In fact, the odds remain precisely the same.

Companies often make bets, believing the odds are better or worse than they are actually the case. For example, a retailer might see a surge in orders as a trend or sign that consumption patterns will soon regress to the mean and order from suppliers accordingly.

Remedies:

a. Assessing reality requires going deeper into underlying causes. Analyze the causes and plot your graphs against the power (budget, energy, externalities, people) to influence the future.

b. Consider one or maybe two downsides and plan against the worst-case scenario.

c. Construct conditional planning “if X then Y” and request 2–3 versions of the expected reality.

d. Always keep an ace in your sleeve. Don’t include it in the main scenario; it would be a bonus or a potential relief.

2. Pessimism/Optimism Bias

It’s natural to feel good or bad about a possible outcome, depending on factors that don’t actually influence the likelihood of something happening. If morale is high or low, people might be expecting the outcome to go one way or the other. Or, the CEO might try to influence confidence or energy to achieve an important goal.

However, it’s easy to overlook potential problems if too optimistic or to miss opportunities or creative solutions when pessimistic. It helps to have a mix of vantage points, which the Board can provide.

Remedies:

a. The Six Thinking Hats (De Bono) theory can help. View the situation through different lenses. Pass any idea from the point of view of the “black hatter” and so on.

b. Diversity in Boards composition is vital. It helps reducing bias against one or the other direction.

c. Honing listening skills. Authentic listening and accepting the opposite opinion’s value are crucial competencies and can be cultivated and incorporated into group norms.

3. The Clustering Illusion

As a pattern spotter, I’m often guilty of this one myself. It’s easy to look at various data points and see a trend when they support one another. Data points must be observed with two independent views. On the one hand, they need to be taken in as isolated events; they are assessed for their correlations or reinforcing indications from another.

For example, it might be elementary to view an increase in refugees, a surge in disease, and a calamitous weather event as signs that global instability is rising, and a company should stay out of a given market. Or these could be isolated events that have nothing to do with one another. Tough times can present “buying” opportunities when other companies are scared.

Remedies:

a. Interpreting data is both art and science. Use experts or testimonies from people who really “lived” the situations behind each data point.

b. Consider different best-fit correlations to explain the data. Brainstorm and debate, especially for essential decision-making exercises, i.e., budget allocations.

c. Test the main hypotheses in the real world.

Cognitive biases can affect small and large decisions. The Board should focus on the big ones. By systematically and analytically considering potential cognitive biases, the Board can model and reinforce the kind of thinking that steers a company through uncertain waters.

Diversity, listening, hypothesis testing, and scenario planning are solutions to avoid the fallacies discussed.

Hey, next week, I’ll talk about more biases and blind spots for Boards.

CTdec20

==========================

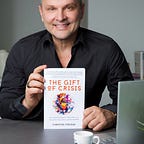

Christos Tsolkas is an Independent Business Advisor, Entrepreneur, and Author of the new book, The Gift of Crisis: How Leaders Use Purpose to Renew their Lives, Change their Organizations, and Save the World.

He has spent more than 25 years in positions of significant responsibility (general management, sales & marketing) with multinationals in the fast-moving consumer goods sector, leading senior teams to achieve high performance and change. His educational background in chemical engineering & business, and he is dedicated to continuous learning.