Board Blind Spots: 12 Cognitive Biases that can Hamper Corporate Performance

Part IV (last)

Boards provide stability for organizations, but they’re also crucial for big directional decisions and course corrections. It’s not easy to straddle those two challenges. But it is easy for cognitive biases to come into play.

It’s easy to know that change is necessary when a crisis comes. The Board will play a massive role in helping the CEO navigate the uncertainty. The danger however is an over-reaction to the situation, resulting in the abandoning of what might still work for the promise of something new or different.

I always advise organizations in times of crisis to get very clear on their purpose — even if that means coming up with a new purpose to help the organization survive in the short term. The Board can do much good by making sure that happens. When the purpose is set, the organization has a way to evaluate big decisions with less confusion.

It’s harder to know that an organization needs to change direction before a crisis comes. The natural tendency is to stay the course until something terrible happens. How do you develop a better sense of the need for change along the way?

Continuing from the previous article …

…keep these last three cognitive biases in mind:

10. Status Quo Bias

So many of the organization’s strategies, processes, and plans assume the status quo without realizing it. Even projections of the future believe that trend lines will continue. And it is deeply human; people don’t like changes. Steady-state condition is the expected one both for organizations and organisms. Of course, nature has developed biological mechanisms for humans that we rely on during crisis, the mind goes on autopilot; the so-called Kahneman “System 1 thinking”, fast reactive, instinctive, often in combination with a spike in cortisol levels in the brain. The world can change dramatically, or a trend line can veer off its expected path.

Then what?

GE spent so much time as one of America’s most dominant companies that it became complacent about its own businesses. When the 2008 great recession hit, GE was way over-extended on its banking business and lost much of its value overnight. It might have seen that danger coming if it had been less stuck on the status quo path. This bias is very similar to the Plan Continuation Fallacy.

Remedies

a. Intentionally plug-in two or three independent events to check the effect on your primary plan (e.g., natural disasters, supply chain disruption, and the like). It’s a kind of a stress test. Can you cope? How would the figures alter? Think of a stall scenario. Operations stop. Can you repurpose it? It’s a sort of a planning drill. What if… then … Are we ready?

b. Annually or biennially run premortem exercises. It is a collective exercise taking individual (and therefore unbiased) inputs of critical individuals. The CEO or the Board describes a horrible hypothetical scenario as a starter in writing. Members of the management are asked to complete the story of what happened and why. The curated summary of all responses can reveal all the hidden, yet unspoken, pain points or strategic choices’ soft spots.

11. The Sunk Cost Fallacy

It’s so easy for an organization to stay committed to a plan, objective, or strategy just because it has invested significant resources, time, and prestige into a decision. Organizations will even do this in the face of compelling data that undercuts the original decision. Economists are calling it “Sunk Cost” and it is an emotional trap. There is a lot of accumulated energy on past choices, vested interests, handlers or decision-makers are exposed and therefore it becomes tough to start from a clean slate.

Three years ago, Amazon, Berkshire Hathaway, and JPMorgan Chase invested in a joint venture called Haven that promised to help reinvent US healthcare. They put a lot of brand capital into the idea, hired big-time talent to lead it, and got much attention from pundits and industry competitors. Recently, they announced the joint venture would fold after failing to have any impact.

Some organizations would hesitate to make that decision and keep the venture going. Instead, Amazon, in particular, took what it learned and used it to inform its other healthcare venture, Amazon Pharmacy.

Remedies

a. When it comes to significant decisions, Boards can recommend to the CEO to allocate a Team B — clean of baggage — in parallel with Team A to prepare the proposal or the rationale. It is a way to minimize bias and look at everything with a fresh eye.

b. Separate the decision from its output. It is a way to alleviate the guilt associated with the sunk cost. After all, a lousy output in the past could have been a result of a sound decision-making process. Therefore, hard feelings are eliminated indeed, and such a fallacy would not occur.

12. The Availability Cascade

Organizations can be incredibly stubborn about the status quo and those sunk costs when the CEO and the Board have done much work selling a strategy or a vision. Pretty soon it gains momentum because so many people in the organization are on-board and invested emotionally.

This view gains even more traction as it gets repeated and reinforced over time. When that happens, it’s easy for critical managers and leaders throughout the organization to become immune to any data indicating the strategy might be wrong. A kind of groupthink sets in. It is similar to Social Media algorithms. You are continuously fed a stream of information that is tightly aligned with your exact likes and preferences. The end result is you omit seeing or experiencing ideas outside of your bubble.

Remedies

a. Work on a very diverse Board composition, frequently (i.e., every three years) refreshed with new members. Rotate members in the Committees too.

b. Ask external advice periodically to mitigate the risks of corporate myopia.

Sounding Board

These fallacies or biases call for the Board to confront assumptions or think around the current path or long-standing assumptions. The Board can help a lot by identifying these assumptions or beliefs and then challenging them with What If scenarios.

What if the market collapses?

What if new regulations suddenly blow up your sales strategy?

What if a global pandemic hit?

Just imagine!

CTdec20

==========================

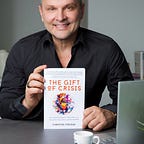

Christos Tsolkas is an Independent Business Advisor, Entrepreneur, and Author of the new book, The Gift of Crisis: How Leaders Use Purpose to Renew their Lives, Change their Organizations, and Save the World.